- Equity Mates: Crypto

- Posts

- Alt Season Tease #247: This One Feels Different... Right?

Alt Season Tease #247: This One Feels Different... Right?

This Week in Crypto

Enjoy this weekly email and want to share it with others? Feel free to forward it!

Have you been forwarded this email? Don’t miss another!

🔥 This week on Crypto Curious — It’s all about Alt Season… or is it?

It’s a massive week in crypto, so let’s start with a plunge dive into alts (what is alt season anyway?), the Genius Act, and the NFTs comeback. Plus, as always, a hefty dose of short, sharps! For the video lovers ❤️our YouTube is here!

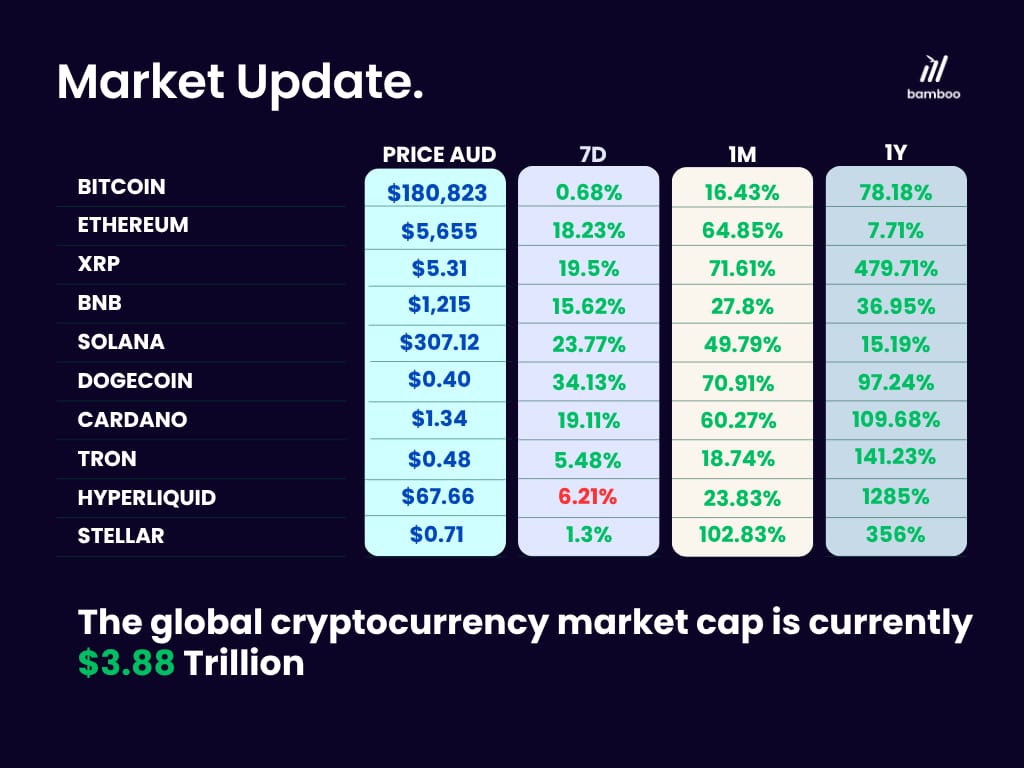

Markets at a glance.

X marks the spot.

Good articles.

Solana (SOL) has crossed the $200 mark for the first time in months, sparking a frenzy of discussion across major social media platforms.

Trump Media strikes hard. The group behind Truth Social formalizes the conversion of 2 billion dollars of its treasury into bitcoin and derivatives. With this announcement, the company shows an aggressive strategy to diversify its liquidity while preparing the integration of a utility token into its digital ecosystem.

As a discreet financial maneuver takes shape in Japan, Arthur Hayes says this subtle central bank shift could be the catalyst behind bitcoin’s next explosive surge.

Q+A.

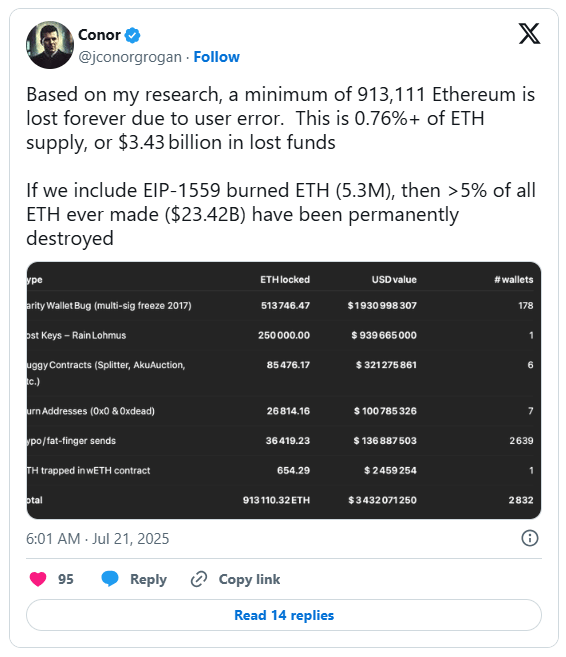

Lost Ethereum?

Unlike traditional finance, where banks can reverse mistaken transactions, crypto offers no such safety net. In the decentralized world of Ethereum, once a transaction is confirmed on the blockchain, it is permanent and irreversible.

How Much Ethereum Has Been Lost?

According to Conor Grogan, Director at Coinbase, over 913,111 ETH—worth approximately $3.4 billion at current prices—has been permanently lost due to human and technical errors. This staggering figure represents around 0.76% of Ethereum’s total circulating supply, currently standing at 120.7 million ETH.

How Much Ethereum Has Been Lost?

According to Conor Grogan, Director at Coinbase, over 913,111 ETH—worth approximately $3.4 billion at current prices—has been permanently lost due to human and technical errors. This staggering figure represents around 0.76% of Ethereum’s total circulating supply, currently standing at 120.7 million ETH.

Why Is Ethereum Lost?

A significant amount of Ethereum has been lost due to three main reasons.

Wrong address transfers: where users mistakenly send ETH to incorrect or non-recoverable addresses. This includes typos, sending funds to contract addresses not designed to receive them, or using incompatible blockchain networks.

Smart contract vulnerabilities. Bugs or coding errors in smart contracts can lead to funds being locked, redirected, or exploited, often permanently, with no way to recover them.

Multisig wallet failures. If a multi-signature wallet is misconfigured, destroyed, or if the required keys are lost, the ETH stored becomes permanently inaccessible.

Read more via Coingape

In Other Crypto News!

‘Block’ Earner.

Warning over new Bitcoin home loans

Australians have a new way of getting into the mortgage market via their Bitcoin holdings, but potential homeowners are being urged to take a deep breath before jumping into one of these products.

In an Australian first launched last week, Bitcoin holders can use the asset like they would traditional money for a home loan.

Mortgages Plus director and principal Chris Dodson told NewsWire that cryptocurrencies were maturing as an asset class, but he urged caution when using them for a home loan.