- Equity Mates: Crypto

- Posts

- Red September or Uptober Ahead?

Red September or Uptober Ahead?

This Week in Crypto

🔥 👉🏼 This week on Crypto Curious we’ve got a big one — Tracey’s stuck in New Zealand this week, so we’ve got Ben Ritchie back to unpack the latest moves in crypto. in this episode:

🚨 Is “Red September” about to strike Bitcoin and the markets again?

🤖 And what happens when AI meets Ethereum? Could it become the backbone of the intelligent economy?

Plus, we’ll hit you with the week’s sharpest news bites, from stablecoins to NFTs, ETFs to metaverse pivots.

Let’s get into it! 🚀

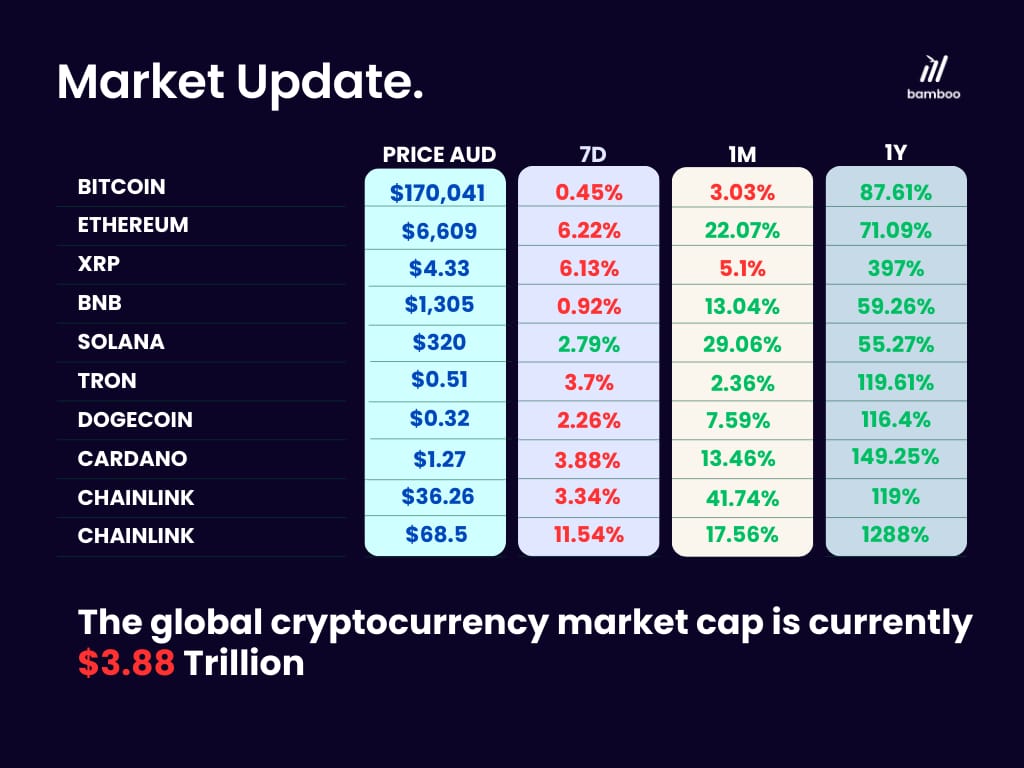

Markets at a glance.

X marks the spot.

Good articles.

World Liberty Financial, a crypto-based, decentralized finance (DeFi) company that was created by Trump’s sons Eric and Don Jr in response to their claims of being de-banked by the financial establishment, will make its WLFI cryptocurrency tradable from September 1.

Whale sell-offs keep Bitcoin capped, but Bailey says clearing them could spark a 36% surge, with some analysts eyeing $180,000–$250,000 by year’s end.

For the first time, both the Securities and Exchange Commission and the Commodity Futures Trading Commission clarified that they both state that nothing in current law prevents registered U.S. exchanges from listing and facilitating the trading of certain spot crypto asset products.

Things you didn’t know (or did you?).

What is Hyperliquid (HYPE), and how does it work?

Hyperliquid is a decentralized perpetual exchange operating on its own high-performance layer-1 blockchain, HyperEVM. It specializes in perpetual futures trading, allowing users to speculate on crypto prices without holding the underlying assets.

The HyperEVM mainnet has been launched with smart contract capabilities while preserving its fast, low-latency trading.

A key feature of Hyperliquid is its onchain order book, which enables real-time, transparent trading with minimal latency.

It bridges the gap between centralized finance (CeFi) and DeFi and offers a seamless, high-speed trading experience tailored for modern decentralized finance (DeFi) users by addressing challenges like inefficient order matching and high latency.

Hyperliquid has adopted a community-driven approach, rejecting venture capital funding, allocating 70% of its tokens to users, and redistributing all revenue back to the community. As of Feb. 5, Hyperliquid has a market capitalization of approximately $8.92 billion.

Via Cointelegraph

In Other Crypto News!